One of the things that frustrate me most often with real estate investing is when people ask you how much below the asking price did you get the property for. The only reason I use the asking price in my financial models is to determine what my cash flow would be if I was to offer the asking price. Asking prices may also be important to you if you are on a strict budget ie) can only purchase homes in the range of $100-200K. This may help narrow down the range of listings you see.

Your goal is to purchase a property that will allow you to generate positive monthly cash flows (rent exceeding expenses including financing costs). Over time if you want to have multiple investment properties you simply can’t afford to keep up if you are pulling money out of your pocket to fund the losses. This must be a strict rule – never buy a property with negative cash flows. I know it’s tempting to think that it’s only $50 or $100 a month believing that the house is going to go up in value and the renters is paying almost all of the mortgage and operating expenses. Don’t do it – if one property has negative cash flow I can guarantee you there are others that will provide you with positive cash flow. Be patient!

I am sure so of you have heard this by others, but it’s simply true. For every 100 properties, you review, you will make an offer on 10 of them and will be accepted for 1 of them. Yes, that’s right, of the 100 properties you analyze you will on average secure only one of them.

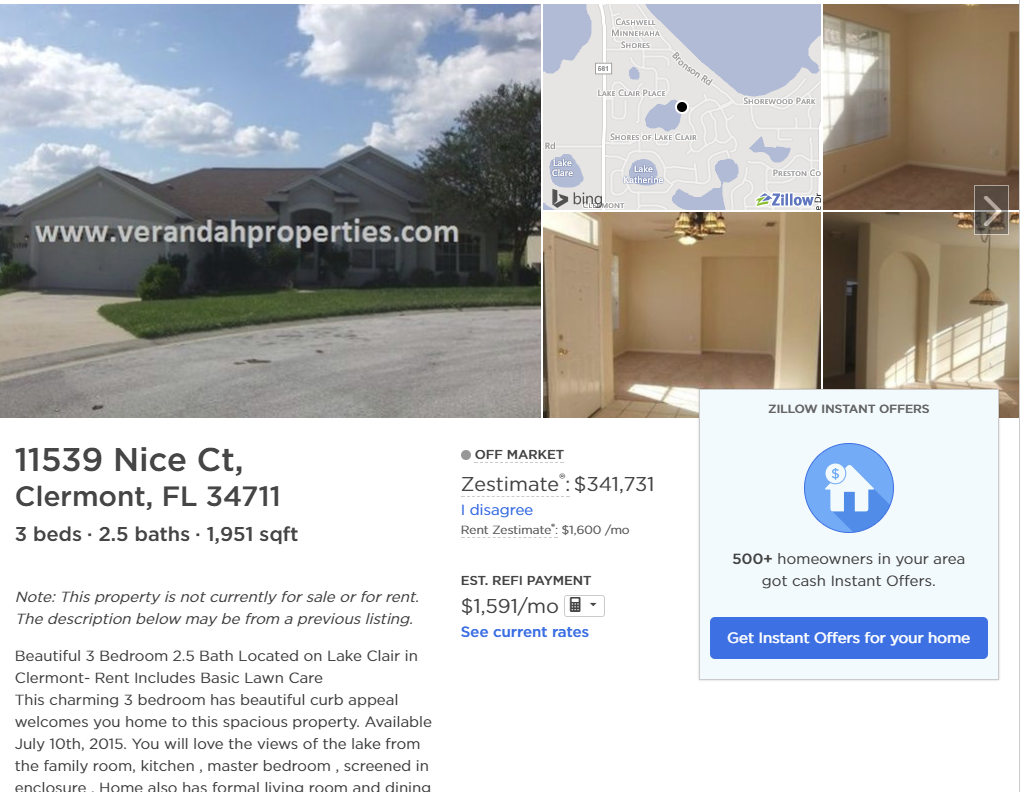

Searching 100 properties might sound like a lot but it’s really not that much work. Once you have defined your goal and have a purchase price range the realtor will begin to send you listings. Once you get the listings you start to analyze each property. The first steps is to determine whether the property is cash flow positive. The first step is to determine how much rent you could get for the property. You have several ways to be able to do this. Your property manager should be very knowledgeable about local rents and can give you a good estimate. Another valuable resource is www.zillow.com. Type in the address in the Zillow website and it will provide you with an estimate of the rent. See the snip it at the bottom of this page for a property I own in Florida. Rent estimate at the bottom of this page is very accurate to what I am getting from my current tenants.

Once you have the rent you will need the following information:

Income

Rent Obtain from Property Manager or website such as Zillow

Vacancy Rate Anywhere from 8-10% of rent. Many web sources can provide an accurate rate in the local area

Expenses

Property Management Use 10% of Rent

Insurance Use a flat rate of $125 per month

Property Taxes Use www.zillow.com or 1-2% of the asking price

HOA Fees Use a flat rate of $100-200 per month

Repairs/Capital Reserve Use 15% of rent as an estimate

Mortgage Payment Use online calculator (include both principal and interest)

After you deduct expenses from your estimated rent you will have a cash flow number. If it’s positive you can begin the process to get better estimates. If it’s a small negative number do not dismiss it because you have the ability to offer less than the asking price or by firming up your estimates. Keep in mind you are running your analysis assuming you will be paying the full asking price. This is how you can determine the exact amount you are willing to pay for a property. Adjusting the asking price so you can get back to a positive cash flow position is a critical part of the offer process. You only put in an offer that will get you back to cash flow positive. Simply dismiss the idea that your offer may be insulting to the seller. Remember you are looking at 100 properties with the expectation you will get an offer accepted on one property. You are looking for the best deal for you not the best deal for the seller. Get used to rejection – it’s part of the process.

Getting pre-approved for financing is critical first step in the process prior to beginning your search. If you have a great deal and want the offer to be enticing to the seller, a condition free offer is good investment strategy. Again, you still might want to put in a condition of inspection to ensure the house is free of a significant defect.

Once again, I can’t stress enough about the importance of achieving positive cash flow through the offer price. Do not base your offer on the listing price. In certain circumstances, you will even offer more than the asking price if the financials are strong and you are competing against other buyers.

Financial models are widely available on the web. If I get some interest from people, I can post my property analyzer spreadsheet.

Your goal is to purchase a property that will allow you to generate positive monthly cash flows (rent exceeding expenses including financing costs). Over time if you want to have multiple investment properties you simply can’t afford to keep up if you are pulling money out of your pocket to fund the losses. This must be a strict rule – never buy a property with negative cash flows. I know it’s tempting to think that it’s only $50 or $100 a month believing that the house is going to go up in value and the renters is paying almost all of the mortgage and operating expenses. Don’t do it – if one property has negative cash flow I can guarantee you there are others that will provide you with positive cash flow. Be patient!

I am sure so of you have heard this by others, but it’s simply true. For every 100 properties, you review, you will make an offer on 10 of them and will be accepted for 1 of them. Yes, that’s right, of the 100 properties you analyze you will on average secure only one of them.

Searching 100 properties might sound like a lot but it’s really not that much work. Once you have defined your goal and have a purchase price range the realtor will begin to send you listings. Once you get the listings you start to analyze each property. The first steps is to determine whether the property is cash flow positive. The first step is to determine how much rent you could get for the property. You have several ways to be able to do this. Your property manager should be very knowledgeable about local rents and can give you a good estimate. Another valuable resource is www.zillow.com. Type in the address in the Zillow website and it will provide you with an estimate of the rent. See the snip it at the bottom of this page for a property I own in Florida. Rent estimate at the bottom of this page is very accurate to what I am getting from my current tenants.

Once you have the rent you will need the following information:

Income

Rent Obtain from Property Manager or website such as Zillow

Vacancy Rate Anywhere from 8-10% of rent. Many web sources can provide an accurate rate in the local area

Expenses

Property Management Use 10% of Rent

Insurance Use a flat rate of $125 per month

Property Taxes Use www.zillow.com or 1-2% of the asking price

HOA Fees Use a flat rate of $100-200 per month

Repairs/Capital Reserve Use 15% of rent as an estimate

Mortgage Payment Use online calculator (include both principal and interest)

After you deduct expenses from your estimated rent you will have a cash flow number. If it’s positive you can begin the process to get better estimates. If it’s a small negative number do not dismiss it because you have the ability to offer less than the asking price or by firming up your estimates. Keep in mind you are running your analysis assuming you will be paying the full asking price. This is how you can determine the exact amount you are willing to pay for a property. Adjusting the asking price so you can get back to a positive cash flow position is a critical part of the offer process. You only put in an offer that will get you back to cash flow positive. Simply dismiss the idea that your offer may be insulting to the seller. Remember you are looking at 100 properties with the expectation you will get an offer accepted on one property. You are looking for the best deal for you not the best deal for the seller. Get used to rejection – it’s part of the process.

Getting pre-approved for financing is critical first step in the process prior to beginning your search. If you have a great deal and want the offer to be enticing to the seller, a condition free offer is good investment strategy. Again, you still might want to put in a condition of inspection to ensure the house is free of a significant defect.

Once again, I can’t stress enough about the importance of achieving positive cash flow through the offer price. Do not base your offer on the listing price. In certain circumstances, you will even offer more than the asking price if the financials are strong and you are competing against other buyers.

Financial models are widely available on the web. If I get some interest from people, I can post my property analyzer spreadsheet.