Why limit yourself to your own backyard?

I was guilty of this early on, but we typically limit our real estate investing to an area we are more comfortable with or confine the search to close to where you live. We simply feel more comfortable with this decision and often feel safer knowing we are able to make sure the tenants are not destroying our investment. Have this limited mindset really does limit the opportunities. That is the beauty of real estate, when one market is closing in on a bubble another market is just beginning the growth curve. I will show you how to find the best cities to invest in now and the future.

Focus on metrics not emotions or news headlines

The secret to unlocking real estate growth is to understand the key metrics. For some experts, they talk about how Detroit is a great value, undervalued with higher than average rents. To that I say, yes you might be able to get great rental yields (higher rent relative to the price you pay for a home), but population is declining because the jobs are simply not there. Population decline has a significant impact on future housing pricing simply because supply will inevitably exceed demand.

Instead, I focus on the following key metrics:

I was guilty of this early on, but we typically limit our real estate investing to an area we are more comfortable with or confine the search to close to where you live. We simply feel more comfortable with this decision and often feel safer knowing we are able to make sure the tenants are not destroying our investment. Have this limited mindset really does limit the opportunities. That is the beauty of real estate, when one market is closing in on a bubble another market is just beginning the growth curve. I will show you how to find the best cities to invest in now and the future.

Focus on metrics not emotions or news headlines

The secret to unlocking real estate growth is to understand the key metrics. For some experts, they talk about how Detroit is a great value, undervalued with higher than average rents. To that I say, yes you might be able to get great rental yields (higher rent relative to the price you pay for a home), but population is declining because the jobs are simply not there. Population decline has a significant impact on future housing pricing simply because supply will inevitably exceed demand.

Instead, I focus on the following key metrics:

- Population must by over 500,000: Why? Larger cities have larger and diversified employment base. Can you imagine a small city or town that is dependent on one employer that either downsizes or closes down? The impact to average incomes and home prices would be dramatic. I am not saying that all cities with populations over 500,000 are immune to job losses as many larger cities are also dependent on a dominant industry such as the auto industry in Detroit or the Oil and Gas industry in Texas. However, my starting point is to always start with bigger cities and eliminate the ones that are dependent on one industry.

- Population Growth: Dove-tailing right off the first point, having a large population is simply not enough. Housing prices have a direct correlation, assuming all other variables remain constant, to population growth patterns. Simply said, if population is growing faster than the national average, housing prices will also rise at a higher rate.

- Average Income Growth: I think this is an obvious one. If you have population growth coupled with average income growth outpacing the price of homes in a specific area, it’s only a matter of time before housing prices increase.

- Price to Rent Ratios: This ratio takes the average price of single family home and divides it by the annual average rents. For example, if the average price of home in a city is $120,000 and the average monthly rent is $1,000. Your price to rent ratio would be 10 (you need to multiply the $1,000 by 12 to get annual rent). Essentially this ratio measures the relative affordability of renting and buying in a given housing market. If you are buying an investment property you would want this ratio to lower relative to other cities you are comparing this to. Another way to think about this ratio is that prior to the housing bubble burst this ratio was at all-time highs. High price to rent ratios are a sure sign the housing market is approaching a correction.

- List Price Drop: This measures the percentage difference between what a house was listed for versus what the house was sold for. Markets that have significant difference between the two indicate that either the demand is low or the supply of housing is high. Markets with a smaller percentage difference (houses are being sold close to the list price) are generally a sign of a strong market.

- Days on the Market: Another good indicator of whether the housing supply is tight. If Days on the Market is lower relative to other cities this means that the housing market demand is high. In general this could be a lead indicator that there is a housing shortage. Housing shortages generally translate into an increase in overall home prices.

- Rental Yield: This is calculated by taking your annual rent and dividing it by the average home price. Markets such as Detroit offer outstanding rental yields (low price, high rent). I would caution investing in markets with high rent yields if population is declining. Over time, if population is declining, the demand for rentals will also follow in the same direction.

- Vacancy Rate: This is percentage of time you can expect your property to be vacant. Low vacancy rate cities are a good indicator of a strong demand for rental properties

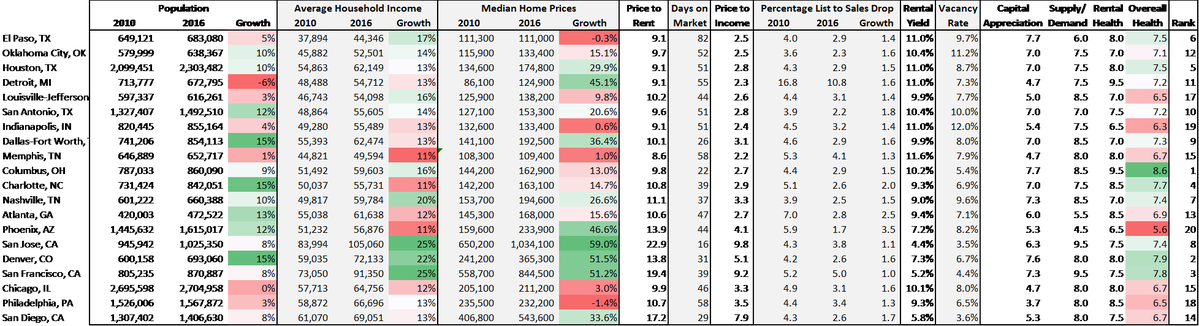

- Final Selection: This is where you take all the metrics noted above and come to your final conclusion. Below is my list with rankings of the top 20 markets I have analyzed. I don’t want to bore you with statistics but essentially you need to weight each of these metrics based on how relevant they are to the house price. Simply stated, some metrics have more impact to the price of home than others. I arrive at my relative weighting by completing a regression analysis on the each of these metrics to see which of these strongly correlate to housing prices. I used historical data to determine how much of housing price increase is due to factors such as population growth, average incomes, price to rent ratio, etc…. I then weight each of these factors to come up with a strong predictor of future performance. Finally, I categorize each of these metrics into three investment goal groupings. Capital appreciation (which cities will see the highest increase in home values), Supply/Demand (which markets have limited housing availability) and Rental Health (which markets have the strongest rental yields). This allows the investor to see which markets are aligned to their investment goals. Some individuals might want to invest in markets purely for rental yields while others want to invest for capital appreciation. I want to invest in neighborhoods that offer all of these so that is why I rank based on a total overall score. See the table below.